richmond property tax rate 2021

What is the real estate tax rate for 2021. The fiscal year 2021 tax rates are.

City Of Richmond Property Tax 2021.

. This sum is raised by applying the citys property tax rate of 12 to the assessed value of the structures which. Richmond residents will have until. The new assessments will be used to calculate tax bills mailed to city property owners next year.

The city of richmond is not accepting. For information and inquiries regarding amounts levied by other taxing authorities. Real estate taxes are due on January 14th and June 14th each year.

Personal Property Taxes are billed once a year with a December 5 th due date. The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value. The residential tax bill is divided as follows.

These documents are provided in Adobe Acrobat PDF format for printing. City of Richmond Tax Department 6911 No. Manage Your Tax Account.

However with rising property. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. To provide additional relief to those who automatically qualify the city has elected to freeze the PPTRA rate at the same rate as 2021.

The real estate tax rate is 120 per 100 of the properties. Understanding Your Tax Bill. Real property consists of land buildings and.

Paying Your Property Taxes. The city has elected to freeze the pptra rate at the same. Richmond property tax rate 2021 Monday June 13 2022 Edit The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Property taxes are due once a year in richmond on the first business day of july. The City of Richmond is not accepting property tax payments in cash until March 31 2021. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Effectively the city is providing relief in addition to what. Richmond Hill accounts for only about a quarter of your tax bill. Car Tax Credit -PPTR.

Richmond residents will have until july 4 to pay their property taxes without penalty. Any remaining outstanding balance after the September 2 2022 due date. The budget calls for lowering the property tax rate from 0687772 to 068.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and. What is the due date of real estate taxes in the City of Richmond. Province of BCs Tax Deferment.

Property Taxes AND Flat Rate Annual Utilities Ten 10 monthly pre-payments August 1 to May 1 are automatically deducted from your bank account on the first of each month. Richmond Hill - 27 per cent of. City of richmond property tax 2021.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. If you do not pay your property taxes on time in full you will be charged a penalty of 5 on your outstanding balance. Due Dates and Penalties for Property Tax.

How are residential property taxes divided. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February.

Millage Rates Richmond County Tax Commissioners Ga

Virginia Property Taxes By County 2022

City Of Richmond Adopts 2022 Budget And Tax Rate

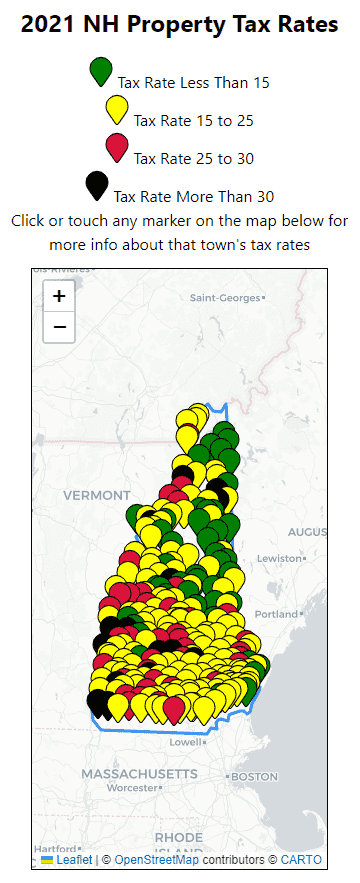

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

About Your Tax Bill City Of Richmond Hill

New York City Property Tax Rate Is It Worth Selling

Maine Property Tax Rates By Town The Master List

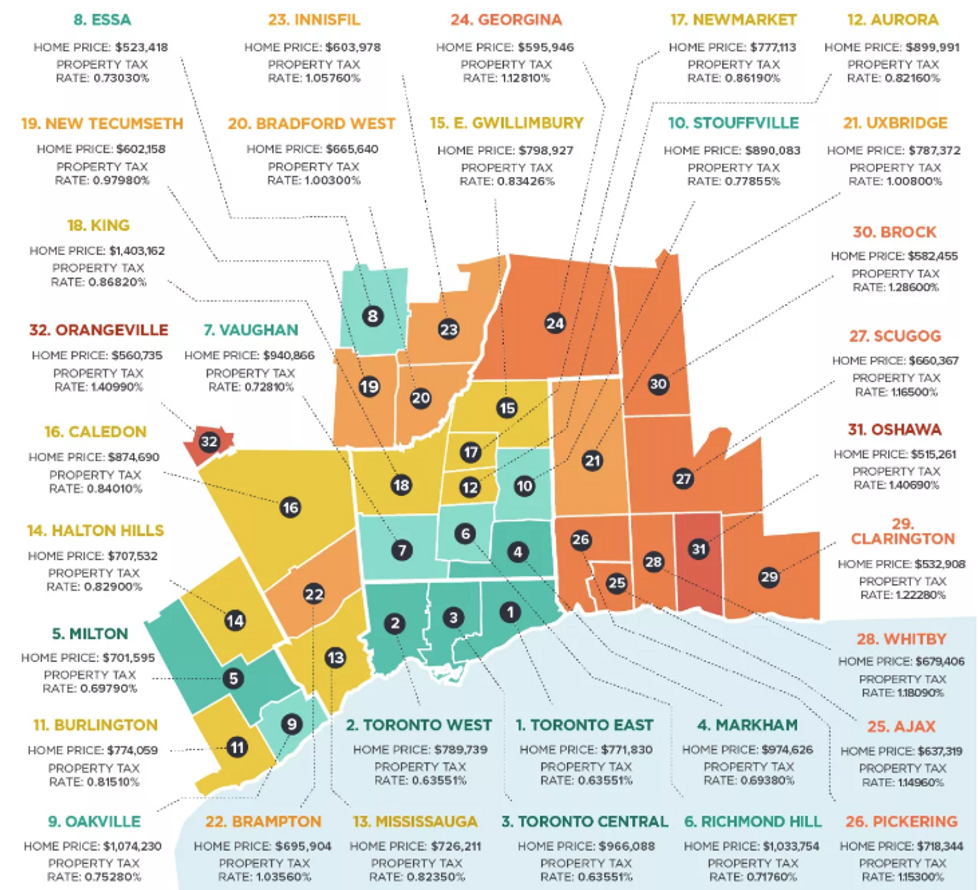

Ontario Property Tax Rates Lowest And Highest Cities

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Richmond Hill Eyes 0 5 Tax Increase For 2021

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

Fm 1464 West Airport Rd Richmond Tx 77407 Loopnet

Tax Bill Information Macomb Mi

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

City Council To Consider Real Estate Tax Rate Richmond Free Press Serving The African American Community In Richmond Va

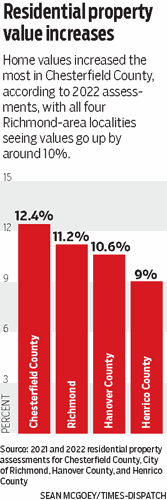

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Many Left Frustrated As Personal Property Tax Bills Increase

Sales Taxes In The United States Wikipedia

Gta Cities With The Highest And Lowest Property Taxes Storeys